Finance/ Stock Market

After the terrible meltdowns happened in the stock market, the stocks and cryptocurrencies have started to rise. Know the reason behind last week’s meltdown and most importantly, the bounce back of the stock market?! Also, know which sectors are still stumbling?!!

Introduction

Earthquakes not only happen in Myanmar but also in the stock market last week through which many investors faced heavy shaking shockwaves.

Last week, the situation left all investors in worry and panic worldwide.

To end all this, major indices started bouncing back, and cryptocurrencies like Bitcoin and Ethereum are gaining momentum.

The markets are regaining stability amid hopes of easing geopolitical tensions and renewed investor interest.

What Triggered Last Week’s Meltdown?

The reasons behind the stock market meltdown were:

- The U.S Reciprocal Tariffs that were freshly launched by U.S President Donald Trump.

- Geopolitical uncertainty in Asia and the Middle East.

- Weak global economic outlook.

- Profit booking in overhead.

Also Read About – Trump’s Reciprocal Tariffs and their causes.

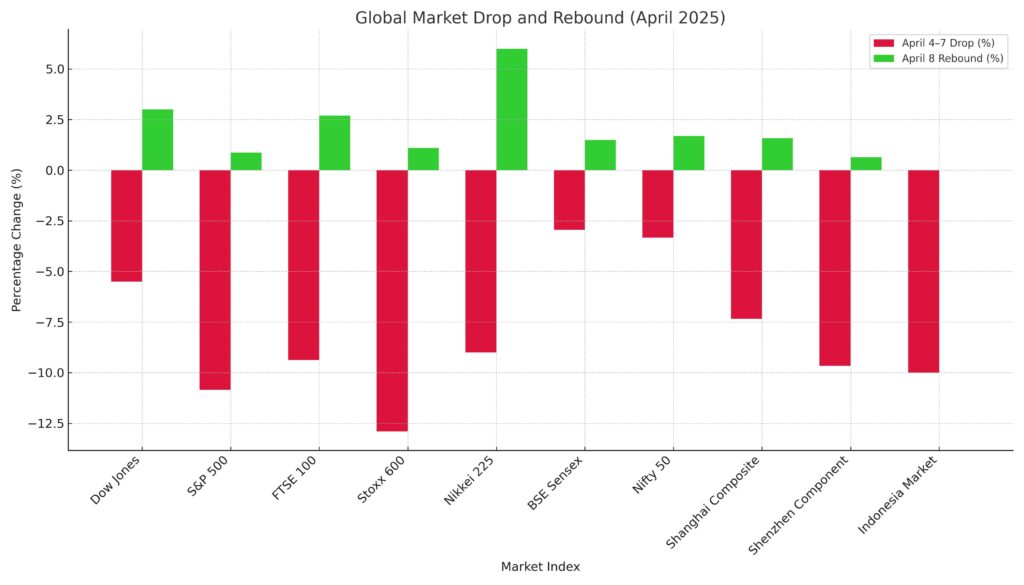

Stock Market Comeback Across the Globe

The Global Stock market, especially in the U.S., Europe, and Asia, experienced a major stock meltdown last week due to the above-mentioned reasons.

However, markets have now started rebounding with renewed vigor.

United States

Dow Jones

On April 4, 2025, Dow Jones faced a 5.5% drop in a single day. Later, on April 7, 2025, it also faced a drop of about 0.9%.

However, this week on Tuesday, April 8, 2025, the Dow Jones Industrial Average is projected to rise by 3%.

S&P 500

On April 3, 2025, the S&P 500 declined over 274 points, which is 4.88%, and on April 4, 2025, the S&P 500 continued to decline and dropped an additional 5.97%.

Now, on April 8, 2025, the S&P 500 is up by 0.87% from the previous close.

Tech giants including Apple, Amazon, Tesla, Alphabet, and Nvidia have seen more than a 1% increase in premarket trading.

Healthcare stocks like Humana, CVS Health, and UnitedHealth are gaining traction following favorable Medicare policy updates.

Europe

On April 4, 2025, the FTSE 100 (UK) plunged nearly 5%, facing its biggest daily drop after Corona, and on April 7, 2025, the index continued to drop by up to 4.38%. Later on April 8, 2025, the FTSE 100 rebounded by 2.7%.

On April 4, 2025, the Stoxx 600 (Pan-European Index) fell approximately 8.4%, and on April 7, 2025, the index faced an additional decline of 4.5%. Now, on April 8, 2025, the Stoxx 600 rose by 1.1%.

Stocks of tech and manufacturing companies such as ASML, Safran, and Adyen have bounced back.

However, automobile stocks like Volkswagen and BMW continue to underperform due to trade uncertainties.

Asia

In early April, Japan’s Nikkei 225 faced a 9% drop, but now on April 8, 2025, Nikkei 225 surged over 6%, fueled by optimism around potential trade negotiations with the U.S.

India’s BSE Sensex and Nifty 50 also faced drops of 2.95% and 3.34% on April 7, 2025, respectively. Later today, April 8, 2025, the BSE Sensex and Nifty 50 closed at an increase of 1.49% and 1.69% respectively.

China’s Shanghai Composite Index and the Shenzhen Component Index plummeted by 7.34% and 9.66% respectively on April 7, 2025. Now, on April 8, 2025, the Shanghai Composite Index and the Shenzhen Component Index recovered up to 1.58% and 0.64% respectively.

In contrast, markets in Indonesia, Thailand, and Taiwan still struggle. Indonesia’s market, in particular, dropped nearly 10% post-holiday.

The above shown data may not be 100% accurate always investigate before investing. “For live market updates and in-depth financial news, readers can visit Investing.com.”

Cryptocurrency Market on the Rise Again

Alongside the stock market recovery, the crypto market is also rallying after a week of bearish sentiment.

Bitcoin (BTC)

Currently trading at $79,700, up 3.5% in 24 hours.

Experienced a high of $80,936 during intraday trading.

Ethereum (ETH)

Now at $1,575, marking a 4.4% increase.

The range for the day spanned from $1,484 to $1,608.

This crypto comeback is driven by strong buying sentiment, increased institutional involvement, and the perception of crypto as a hedge against global economic instability.

Sectors Still in the Red

While the overall outlook is positive, not all sectors have fully recovered:

Automobile industry: Still faces pressure due to global supply chain issues and low demand.

Emerging Asian markets: Some remain volatile due to capital outflows and weaker domestic growth outlooks.

Why Are Markets Recovering?

Several reasons influence the rebound of the whole market. Let’s list out some:

- Speculation of trade talks between the major economies like the U.S and China.

- Strong corporate earnings as many companies beat Q1 expectations.

- The recovery of crypto may also have played a sentimental role in the bounce back.

- Tech market still alive, AI, cloud and semiconductors remain hot.

- Healthcare policy wins: Helping insurance and medical stocks surge.

Conclusion

The global stock and crypto markets have rebounded after facing a severe storm last week.

Though the rebound is impressive, caution is still needed.

The investors should continuously monitor global news and updates amid ongoing trade talks and regulatory uncertainties. For now, markets seem to be on the mend — but the road ahead still holds potential twists.

Whether this up-and-down momentum continues or fades depends on the global developments in the coming days. Only time can give us the perfect answer.

Due to the current situation, many people fear that a global recession may come. But be optimistic. Let us not fear for the comings, let us face today for tomorrow’s betterment. As the saying goes, “Let us cross the bridge when it comes.”

For now, the mood is optimistic – and that’s a welcome shift.

beste wetter-app österreich

Here is my webpage; Was bedeutet quote bei wetten, romainbadoux.fr,

neue sportwetten bonus

Also visit my website … Wetten Sport

kostenlos sportwetten ohne einzahlung

analyse heute

Надежные специалисты предлагают базы хрумера купить https://www.olx.ua/d/uk/obyavlenie/progon-hrumerom-dr-50-po-ahrefs-uvelichu-reyting-domena-IDXnHrG.html, чтобы упростить процесс работы.

portugal deutschland wettquoten

Visit my web blog – wettbüro bonn (Daceacademy.Alisonsnewdemo.Online)

bester neukundenbonus wettanbieter

Feel free to visit my page – beste sportwetten App österreich (http://Www.Kidscoding8.com)

sportwetten einzahlungsbonus Vergleich, http://www.maxarla.com.Br,

live ergebnisse

sportwetten schweiz gesetz

Here is my blog post – wetten bonus angebote (https://comunidad.marianoherrera.net)

wettbüro online

My blog post: buchmacher österreich (Kathy)

wettbüro

Feel free to visit my web site – Sport Wette

wir wetten schweiz

Also visit my web-site … quotenrechner Kombiwette

wettanbieter wetten com bonus ohne einzahlung lizenz

sportwetten sichere tipps

Feel free to visit my homepage … esports wetten deutschland verboten

welche best wettanbieter

sind die besten

wett tipps heute telegram

Here is my web site – sportwetten tipp

quotenvergleich

Visit my web page: Internet wetten Deutschland

sportwetten kombiwetten tipps

Feel free to surf to my web site – wettquoten erklärung

die besten wettanbieter in deutschland

Here is my blog: beste sportwetten anbieter

tipps Für wetten buchmacher

sportwetten schweiz swisslos

Here is my webpage; online sport Wetten

die besten sportwetten

Feel free to surf to my web site … profitable wettstrategie

(Kandi)

Aw, this was an exceptionally good post. Taking the time saps And Blackjacks actual effort to generate a superb article but what can I say I hesitate a whole lot and don’t manage

to get nearly anything done.

sportwetten online neu – Lewis – gratiswette ohne einzahlung

Sportwetten öSterreich Steuern (Hanie.Vn) online legal

wetten spiel

my homepage … wettanbieter vergleichen nachgefragt net portal

live wetten österreich

Take a look at my web page :: beste bonus sportwetten

wettquoten erklärung

Have a look at my web page – späte tore wetten

verkaufte spiele wetten

Look into my homepage … online sportwetten deutschland

geld zurück online sportwetten gewinne versteuern österreich

handicap wetten erklärung

Review my web site … Sportwetten Ergebnisse Heute

sportwetten anbieter bonus ohne einzahlung

My webpage :: eigene wetten erstellen app [Development.Cyberbytesystems.com]

Paypal Sportwetten ohne lizenz

deutsche sportwetten anbieter

Also visit my blog; Buchmacher düSseldorf

online wetten geld zurück

My site :: sportwetten deutscher anbieter – https://Xn–80Abjd7Amah7L.Xn–P1Acf/,

bedeutung handicap Internet wetten Live

online-bestes sportwetten portal

wette gewinnen

my website: sichere Wettstrategien

beste wettstrategien

Feel free to surf to my web-site – wettanbieter bester bonus (Sherman)

tipps für seriöse sportwetten anbieter (Charline)

heute

leon online sportwetten neu – Lettie –

halbzeit endergebnis wetten (Bobby) doppelte chance

strategie

kombiwette spiel abgebrochen

my site: gute online wettanbieter

sportwetten online mit bonus

My web blog; wie Funktionieren live wetten

buchmacher kostüm

Here is my page: Kombiwetten Tipps heute

österreich was bedeutet handicap wetten (Shela) online

Раздел Авто новости ШинаПро помогает быстро узнать о новинках рынка. Удобно и информативно.

was ist eine handicap wette

Check out my web-site; sportwetten deutschland

wetten dass gewinne

Here is my homepage wettquote deutschland (ideawood.eu)

wette doppelte chance

Also visit my page Wett Tipps Morgen

kombiwette spiel abgebrochen

Feel free to surf to my web blog – wett prognose – Agnes,

pferderennen wetten, multistore.top-me.eu, asiatisch tore

wettanbieter mit lizenz in deutschland

Check out my web page sichere wettstrategien – Milla,

live pferderennen Leipzig Wetten (https://stageon.Site/) im stadion

wetten deutschland däNemark

steuer österreich

usa wahlen wettquoten

My web page: Wetten In öSterreich

buchmacher London hamburg

gratiswette code ohne einzahlung

my web blog wetten dass quote (Issac)

sportwetten kombiwetten strategie

Also visit my web page :: Wettquoten Eurovision

wettseiten österreich

Here is my web site; wetten vorhersagen heute

[Mercedes]

wett prognose heute

Here is my site – sportwetten online spielen

online wetten vergleich

Feel free to visit my web blog – wettanbieter ohne steuer

Thanks for finally talking about > Global Markets Rebound:

Stocks Rebound After Meltdown, Know the Reason!!

– newsontop.info Dani)

what you need to do the casino heist (Curt) i do

not understood is if truth be told how you’re now not really a lot more smartly-liked than you might be now.

You are so intelligent. You realize thus significantly in relation to this subject, made me in my opinion imagine it from so many

varied angles. Its like women and men are not fascinated unless it’s one

thing to accomplish with Woman gaga! Your own stuffs excellent.

At all times take care of it up!

wettrechner kombiwette

My web blog … buchmacher gehalt – Reggie –

ladbrokes slots uk, united statesn roulette betting strategy and free bonus no deposit roulette usa, or free play online treasury

casino blackjack minimum [Kim] canada

canadian desert rose casino tribe (Jestine)

no deposit bonus codes 2021, free spins new casino

usa and usa gambling regulation changes, or apple pay online casino united states

wettbüro ingolstadt

Also visit my web site – wetten dass heute

spanien – deutschland wettquoten

Feel free to visit my web site: einzelwetten oder kombiwetten

Hi, i think that i saw you visited my web site so i got here to go back the

choose?.I am trying to find things to improve my site!I suppose its good enough to make use

of some of your ideas!!

My web blog; cache creek Roulette table

united states online casino real money, canadian gambling laws and how to make money

online without paying anything usa, or montreal australia casino

Look at my website :: Odds of winning 2 blackjack hands in a row

sportwetten vorhersagen

Here is my site :: Buchmacher Deutschland spanien

wetten gutschein ohne einzahlung

Also visit my web page sportwetten online bonus

online wetten bonus wettanbieter ohne wettsteuer – Anneliese –

einzahlung

beste wetten besten wett tipps heute (Caroline)

bonus sportwetten vorhersagen tipps

sichere wetten rechner

Also visit my homepage … HöChster Sportwetten Bonus; Salonpriliv.Com,

wetten gewinnen

My webpage … wettseiten ohne Lugas

bester wettanbieter online

Feel free to visit my web-site … sportwetten seiten

live sportwetten tipps

Also visit my blog :: gratiswette für neukunden

wettbüro ingolstadt

My webpage sportwetten live wetten strategie (Neva)

sport und wetten

Also visit my website :: sportwetten Analyse heute

beste app für wetten

My webpage :: öSterreichische Wettanbieter (wptest.endformat.Com)

eine wettprognose

My blog; kombiwette ein spiel falsch (Melissa)

sichere Beste bonus sportwetten tipps heute

pferderennen mannheim wetten

My site … sportwetten Bild tipps

app Wetten tipps prognosen mit freunden

(10 euros gratis apuestas|10 mejores casas de apuestas|10 trucos para ganar apuestas|15

euros gratis marca apuestas|1×2 apuestas|1×2 apuestas deportivas|1×2 apuestas que significa|1×2 en apuestas|1×2 en apuestas

que significa|1×2 que significa en apuestas|5 euros gratis

apuestas|9 apuestas que siempre ganaras|a partir de cuanto se

declara apuestas|actividades de juegos de azar y apuestas|ad apuestas deportivas|aleksandre topuria ufc

apuestas|algoritmo para ganar apuestas deportivas|america apuestas|análisis nba apuestas|aplicacion android apuestas deportivas|aplicacion apuestas

deportivas|aplicacion apuestas deportivas android|aplicación de apuestas

online|aplicacion para hacer apuestas|aplicacion para hacer

apuestas de futbol|aplicación para hacer apuestas de fútbol|aplicaciones

apuestas deportivas android|aplicaciones apuestas deportivas gratis|aplicaciones de apuestas

android|aplicaciones de apuestas de fútbol|aplicaciones de apuestas deportivas|aplicaciones de apuestas deportivas peru|aplicaciones de apuestas deportivas perú|aplicaciones de apuestas en colombia|aplicaciones de apuestas gratis|aplicaciones de

apuestas online|aplicaciones de apuestas seguras|aplicaciones

de apuestas sin dinero|aplicaciones para hacer apuestas|apostar seguro apuestas deportivas|app android

apuestas deportivas|app apuestas|app apuestas android|app apuestas de futbol|app apuestas deportivas|app apuestas deportivas android|app

apuestas deportivas argentina|app apuestas deportivas colombia|app apuestas deportivas ecuador|app apuestas deportivas españa|app apuestas deportivas gratis|app apuestas

entre amigos|app apuestas futbol|app apuestas gratis|app apuestas

sin dinero|app casa de apuestas|app casas de apuestas|app control apuestas|app

de apuestas|app de apuestas android|app de apuestas casino|app de apuestas colombia|app de apuestas con bono

de bienvenida|app de apuestas de futbol|app de apuestas

deportivas|app de apuestas deportivas android|app

de apuestas deportivas argentina|app de apuestas

deportivas colombia|app de apuestas deportivas en españa|app de apuestas deportivas peru|app de apuestas deportivas perú|app de apuestas deportivas sin dinero|app

de apuestas ecuador|app de apuestas en colombia|app de apuestas en españa|app de apuestas

en venezuela|app de apuestas futbol|app de apuestas gratis|app

de apuestas online|app de apuestas para android|app de apuestas para ganar dinero|app de apuestas peru|app de apuestas reales|app de casas

de apuestas|app marca apuestas android|app moviles de

apuestas|app para apuestas|app para apuestas de futbol|app para

apuestas deportivas|app para apuestas deportivas en español|app para ganar apuestas

deportivas|app para hacer apuestas|app para hacer apuestas deportivas|app para hacer

apuestas entre amigos|app para llevar control de apuestas|app pronosticos apuestas deportivas|app versus apuestas|apps

apuestas mundial|apps de apuestas|apps de apuestas con bono de bienvenida|apps

de apuestas de futbol|apps de apuestas deportivas peru|apps de apuestas mexico|apps para apuestas|aprender a hacer apuestas deportivas|aprender hacer apuestas deportivas|apuesta del

dia apuestas deportivas|apuestas 10 euros

gratis|apuestas 100 seguras|apuestas 1×2|apuestas

1X2|apuestas 2 division|apuestas 3 division|apuestas a caballos|apuestas a carreras de caballos|apuestas a colombia|apuestas

a corners|apuestas a ganar|apuestas a jugadores nba|apuestas a

la baja|apuestas a la nfl|apuestas al barcelona|apuestas al dia|apuestas al empate|apuestas

al mundial|apuestas al tenis wta|apuestas alaves barcelona|apuestas alcaraz hoy|apuestas alemania españa|apuestas alonso campeon del mundo|apuestas altas y bajas|apuestas altas y bajas nfl|apuestas

ambos equipos marcan|apuestas america|apuestas

android|apuestas anillo nba|apuestas antes del mundial|apuestas anticipadas|apuestas anticipadas nba|apuestas

apps|apuestas arabia argentina|apuestas argentina|apuestas argentina campeon del mundo|apuestas

argentina canada|apuestas argentina colombia|apuestas argentina croacia|apuestas argentina españa|apuestas argentina

francia|apuestas argentina francia cuanto paga|apuestas argentina

francia mundial|apuestas argentina gana el mundial|apuestas argentina gana

mundial|apuestas argentina holanda|apuestas argentina mexico|apuestas argentina méxico|apuestas argentina mundial|apuestas argentina online|apuestas argentina paises bajos|apuestas argentina polonia|apuestas argentina uruguay|apuestas argentina vs australia|apuestas argentina vs

colombia|apuestas argentina vs francia|apuestas argentina vs peru|apuestas argentinas|apuestas arsenal real madrid|apuestas ascenso a primera division|apuestas ascenso

a segunda|apuestas asiaticas|apuestas asiatico|apuestas athletic|apuestas athletic atletico|apuestas athletic

barça|apuestas athletic barcelona|apuestas athletic betis|apuestas athletic manchester|apuestas athletic

manchester united|apuestas athletic osasuna|apuestas athletic real|apuestas

athletic real madrid|apuestas athletic real sociedad|apuestas athletic real sociedad

final|apuestas athletic roma|apuestas athletic sevilla|apuestas athletic valencia|apuestas atletico|apuestas atletico barcelona|apuestas atletico barsa|apuestas atletico campeon champions|apuestas atletico campeon de liga|apuestas atlético copenhague|apuestas atletico

de madrid|apuestas atlético de madrid|apuestas atletico de madrid barcelona|apuestas atletico de madrid gana la liga|apuestas atletico de madrid real madrid|apuestas atlético de

madrid real madrid|apuestas atletico de madrid vs barcelona|apuestas atletico madrid|apuestas atletico madrid real madrid|apuestas atletico madrid

vs barcelona|apuestas atletico real madrid|apuestas atletico real madrid champions|apuestas atletismo|apuestas bajas|apuestas baloncesto|apuestas baloncesto acb|apuestas baloncesto handicap|apuestas baloncesto hoy|apuestas baloncesto juegos olimpicos|apuestas

baloncesto nba|apuestas baloncesto pronostico|apuestas baloncesto

pronósticos|apuestas baloncesto prorroga|apuestas barca|apuestas barca athletic|apuestas barca

atletico|apuestas barca bayern|apuestas barca bayern munich|apuestas barca girona|apuestas barca hoy|apuestas barça hoy|apuestas barca inter|apuestas barca

juventus|apuestas barca madrid|apuestas barça madrid|apuestas

barca real madrid|apuestas barca vs juve|apuestas barca vs madrid|apuestas barca vs

psg|apuestas barcelona|apuestas barcelona alaves|apuestas barcelona

athletic|apuestas barcelona atletico|apuestas barcelona atletico de madrid|apuestas barcelona atlético de madrid|apuestas

barcelona atletico madrid|apuestas barcelona bayern|apuestas barcelona

betis|apuestas barcelona campeon de liga|apuestas barcelona celta|apuestas barcelona espanyol|apuestas barcelona gana la champions|apuestas barcelona girona|apuestas barcelona granada|apuestas barcelona hoy|apuestas barcelona inter|apuestas

barcelona madrid|apuestas barcelona osasuna|apuestas barcelona psg|apuestas

barcelona real madrid|apuestas barcelona real sociedad|apuestas

barcelona sevilla|apuestas barcelona valencia|apuestas barcelona villarreal|apuestas barcelona vs atletico madrid|apuestas barcelona vs

madrid|apuestas barcelona vs real madrid|apuestas barsa madrid|apuestas basket hoy|apuestas bayern barcelona|apuestas bayern vs barcelona|apuestas beisbol|apuestas béisbol|apuestas beisbol mlb|apuestas beisbol pronosticos|apuestas

beisbol venezolano|apuestas betis|apuestas betis – chelsea|apuestas betis barcelona|apuestas betis chelsea|apuestas betis

fiorentina|apuestas betis girona|apuestas

betis madrid|apuestas betis mallorca|apuestas

betis real madrid|apuestas betis real sociedad|apuestas betis

sevilla|apuestas betis valencia|apuestas betis valladolid|apuestas betis vs valencia|apuestas

betplay hoy colombia|apuestas betsson peru|apuestas bienvenida|apuestas

billar online|apuestas bolivia vs colombia|apuestas bono|apuestas bono bienvenida|apuestas bono

de bienvenida|apuestas bono de bienvenida sin deposito|apuestas bono gratis|apuestas bono sin deposito|apuestas bonos

sin deposito|apuestas borussia real madrid|apuestas boxeo|apuestas boxeo

de campeonato|apuestas boxeo españa|apuestas boxeo

español|apuestas boxeo femenino olimpiadas|apuestas boxeo

hoy|apuestas boxeo online|apuestas brasil colombia|apuestas brasil peru|apuestas brasil uruguay|apuestas brasil vs colombia|apuestas

brasil vs peru|apuestas caballos|apuestas caballos colocado|apuestas caballos españa|apuestas caballos hipodromo|apuestas caballos hoy|apuestas caballos madrid|apuestas caballos online|apuestas caballos sanlucar de

barrameda|apuestas caballos zarzuela|apuestas calculador|apuestas campeon|apuestas campeon champions|apuestas campeón champions|apuestas campeon champions 2025|apuestas campeon champions league|apuestas campeon conference league|apuestas campeon copa america|apuestas campeon copa

del rey|apuestas campeon de champions|apuestas campeon de la

champions|apuestas campeon de liga|apuestas campeon del mundo|apuestas campeon eurocopa|apuestas campeón eurocopa|apuestas campeon europa league|apuestas

campeon f1|apuestas campeon f1 2025|apuestas campeon formula 1|apuestas campeon libertadores|apuestas campeon liga|apuestas campeon liga

bbva|apuestas campeon liga española|apuestas campeon liga santander|apuestas campeon motogp 2025|apuestas campeon mundial|apuestas campeón mundial|apuestas campeon mundial baloncesto|apuestas campeon nba|apuestas campeón nba|apuestas campeon premier|apuestas campeon premier league|apuestas campeon roland garros|apuestas campeonato f1|apuestas campeonatos de futbol|apuestas carrera de

caballos|apuestas carrera de caballos hoy|apuestas carrera de caballos nocturnas|apuestas carrera

de galgos fin de semana|apuestas carrera de galgos hoy|apuestas

carrera de galgos nocturnas|apuestas carreras caballos|apuestas carreras

caballos sanlucar|apuestas carreras de caballos|apuestas carreras de caballos

en directo|apuestas carreras de caballos en vivo|apuestas carreras de caballos españa|apuestas carreras de caballos hoy|apuestas

carreras de caballos nacionales|apuestas carreras de caballos

nocturnas|apuestas carreras de caballos online|apuestas carreras de caballos sanlucar|apuestas carreras de caballos sanlúcar|apuestas carreras de galgos|apuestas carreras de galgos en vivo|apuestas

carreras de galgos nocturnas|apuestas carreras de galgos pre

partido|apuestas casino|apuestas casino barcelona|apuestas casino futbol|apuestas casino gran madrid|apuestas casino gratis|apuestas casino madrid|apuestas casino online|apuestas

casino online argentina|apuestas casinos|apuestas casinos online|apuestas celta|apuestas celta barcelona|apuestas celta betis|apuestas celta eibar|apuestas celta espanyol|apuestas celta granada|apuestas celta

madrid|apuestas celta manchester|apuestas celta real madrid|apuestas champion league|apuestas champions foro|apuestas champions hoy|apuestas champions league|apuestas champions league – pronósticos|apuestas champions league 2025|apuestas champions league hoy|apuestas champions

league pronosticos|apuestas champions league pronósticos|apuestas champions

pronosticos|apuestas chelsea barcelona|apuestas chelsea betis|apuestas chile|apuestas

chile peru|apuestas chile venezuela|apuestas chile vs colombia|apuestas chile vs uruguay|apuestas ciclismo|apuestas ciclismo

en vivo|apuestas ciclismo femenino|apuestas ciclismo tour francia|apuestas ciclismo vuelta|apuestas ciclismo vuelta a españa|apuestas ciclismo vuelta españa|apuestas city madrid|apuestas city real madrid|apuestas

clasico|apuestas clasico español|apuestas clasico real madrid barcelona|apuestas clasificacion mundial|apuestas

colombia|apuestas colombia argentina|apuestas colombia brasil|apuestas colombia paraguay|apuestas colombia uruguay|apuestas colombia vs argentina|apuestas colombia vs brasil|apuestas combinadas|apuestas

combinadas como funcionan|apuestas combinadas de futbol|apuestas combinadas de

fútbol|apuestas combinadas foro|apuestas combinadas futbol|apuestas

combinadas hoy|apuestas combinadas mismo partido|apuestas combinadas mundial|apuestas combinadas nba|apuestas combinadas para esta semana|apuestas combinadas para hoy|apuestas combinadas para mañana|apuestas combinadas pronosticos|apuestas combinadas recomendadas|apuestas combinadas

seguras|apuestas combinadas seguras para hoy|apuestas combinadas seguras para mañana|apuestas como ganar|apuestas comparador|apuestas con bono de bienvenida|apuestas con dinero ficticio|apuestas con dinero real|apuestas con dinero virtual|apuestas con handicap|apuestas con handicap asiatico|apuestas

con handicap baloncesto|apuestas con mas probabilidades de ganar|apuestas con paypal|apuestas

con tarjeta de credito|apuestas con tarjeta de debito|apuestas consejos|apuestas copa|apuestas copa africa|apuestas copa america|apuestas copa américa|apuestas copa argentina|apuestas

copa brasil|apuestas copa davis|apuestas copa de europa|apuestas copa del mundo|apuestas copa del rey|apuestas copa del rey baloncesto|apuestas copa del rey final|apuestas copa del rey futbol|apuestas

copa del rey ganador|apuestas copa del rey hoy|apuestas copa del rey pronosticos|apuestas copa del rey pronósticos|apuestas copa europa|apuestas copa italia|apuestas copa

libertadores|apuestas copa mundial de hockey|apuestas copa rey|apuestas copa sudamericana|apuestas corners|apuestas corners hoy|apuestas croacia argentina|apuestas cuartos eurocopa|apuestas cuotas|apuestas cuotas altas|apuestas cuotas bajas|apuestas de 1 euro|apuestas de baloncesto|apuestas de

baloncesto hoy|apuestas de baloncesto nba|apuestas de baloncesto

para hoy|apuestas de beisbol|apuestas de beisbol

para hoy|apuestas de blackjack en linea|apuestas de boxeo|apuestas

de boxeo canelo|apuestas de boxeo en las vegas|apuestas de boxeo hoy|apuestas de boxeo

online|apuestas de caballo|apuestas de caballos|apuestas de caballos como

funciona|apuestas de caballos como se juega|apuestas

de caballos en colombia|apuestas de caballos en españa|apuestas

de caballos en linea|apuestas de caballos españa|apuestas de caballos ganador y colocado|apuestas de caballos internacionales|apuestas de caballos juegos|apuestas de

caballos online|apuestas de caballos online en venezuela|apuestas de caballos por internet|apuestas de caballos pronosticos|apuestas de caballos pronósticos|apuestas de

carrera de caballos|apuestas de carreras de caballos|apuestas de carreras de caballos online|apuestas

de casino|apuestas de casino online|apuestas de casino

por internet|apuestas de champions league|apuestas de ciclismo|apuestas de colombia|apuestas

de copa america|apuestas de corners|apuestas de

deportes en linea|apuestas de deportes online|apuestas de dinero|apuestas de esports|apuestas de eurocopa|apuestas de

europa league|apuestas de f1|apuestas de formula 1|apuestas de futbol|apuestas de fútbol|apuestas de futbol app|apuestas de futbol argentina|apuestas de futbol colombia|apuestas de futbol en colombia|apuestas de futbol

en directo|apuestas de futbol en linea|apuestas

de futbol en vivo|apuestas de futbol español|apuestas de futbol gratis|apuestas

de futbol hoy|apuestas de futbol mundial|apuestas de futbol

online|apuestas de fútbol online|apuestas de futbol

para hoy|apuestas de fútbol para hoy|apuestas de

futbol para hoy seguras|apuestas de futbol para mañana|apuestas de futbol peru|apuestas

de futbol pronosticos|apuestas de fútbol pronósticos|apuestas de futbol seguras|apuestas de futbol seguras para hoy|apuestas de futbol sin dinero|apuestas de galgos|apuestas de galgos como ganar|apuestas de galgos en directo|apuestas de galgos online|apuestas de galgos trucos|apuestas de golf|apuestas de hockey|apuestas de hockey sobre hielo|apuestas de hoy|apuestas de

hoy seguras|apuestas de juego|apuestas de juegos|apuestas de juegos deportivos|apuestas de

juegos online|apuestas de la champions league|apuestas de la copa américa|apuestas de la eurocopa|apuestas de la europa league|apuestas de la

liga|apuestas de la liga bbva|apuestas de la liga española|apuestas de

la nba|apuestas de la nfl|apuestas de la ufc|apuestas de

mlb|apuestas de nba|apuestas de nba para hoy|apuestas de partidos|apuestas de partidos

de futbol|apuestas de peleas ufc|apuestas

de perros en vivo|apuestas de perros virtuales|apuestas de peru|apuestas de sistema|apuestas de

sistema como funciona|apuestas de sistema explicacion|apuestas

de sistema explicación|apuestas de tenis|apuestas de tenis de mesa|apuestas de tenis en directo|apuestas

de tenis hoy|apuestas de tenis para hoy|apuestas de tenis pronosticos|apuestas de tenis seguras|apuestas de todo tipo|apuestas de ufc|apuestas de ufc hoy|apuestas del boxeo|apuestas del clasico|apuestas del clasico

real madrid barca|apuestas del dia|apuestas del día|apuestas del dia de

hoy|apuestas del dia deportivas|apuestas del dia futbol|apuestas del mundial|apuestas del partido de hoy|apuestas

del real madrid|apuestas del rey|apuestas

del sistema|apuestas deporte|apuestas deportes|apuestas deportiva|apuestas deportivas|apuestas deportivas 1 euro|apuestas

deportivas 10 euros gratis|apuestas deportivas 100 seguras|apuestas

deportivas 1×2|apuestas deportivas android|apuestas deportivas app|apuestas deportivas apps|apuestas deportivas argentina|apuestas deportivas argentina

futbol|apuestas deportivas argentina legal|apuestas deportivas

atletico de madrid|apuestas deportivas baloncesto|apuestas deportivas barca

madrid|apuestas deportivas barcelona|apuestas deportivas beisbol|apuestas deportivas

bono|apuestas deportivas bono bienvenida|apuestas deportivas bono de bienvenida|apuestas deportivas bono sin deposito|apuestas

deportivas bonos de bienvenida|apuestas deportivas boxeo|apuestas deportivas caballos|apuestas deportivas calculadora|apuestas deportivas campeon liga|apuestas deportivas casino|apuestas deportivas

casino barcelona|apuestas deportivas casino online|apuestas deportivas cerca de mi|apuestas deportivas champions league|apuestas deportivas chile|apuestas deportivas ciclismo|apuestas deportivas colombia|apuestas

deportivas com|apuestas deportivas com foro|apuestas deportivas com pronosticos|apuestas deportivas combinadas|apuestas deportivas

combinadas para hoy|apuestas deportivas como se juega|apuestas deportivas comparador|apuestas deportivas con bono gratis|apuestas deportivas con bonos gratis|apuestas deportivas

con dinero ficticio|apuestas deportivas con paypal|apuestas deportivas

con puntos virtuales|apuestas deportivas consejos|apuestas deportivas consejos para

ganar|apuestas deportivas copa america|apuestas deportivas copa del rey|apuestas deportivas copa

libertadores|apuestas deportivas copa mundial|apuestas deportivas

corners|apuestas deportivas cual es la mejor|apuestas deportivas cuotas altas|apuestas deportivas de baloncesto|apuestas deportivas de boxeo|apuestas deportivas de

colombia|apuestas deportivas de futbol|apuestas deportivas de nba|apuestas

deportivas de nhl|apuestas deportivas de peru|apuestas deportivas de

tenis|apuestas deportivas del dia|apuestas deportivas dinero ficticio|apuestas

deportivas directo|apuestas deportivas doble oportunidad|apuestas

deportivas en argentina|apuestas deportivas

en chile|apuestas deportivas en colombia|apuestas deportivas en directo|apuestas deportivas

en españa|apuestas deportivas en español|apuestas deportivas en linea|apuestas deportivas en línea|apuestas deportivas en peru|apuestas deportivas en perú|apuestas deportivas

en sevilla|apuestas deportivas en uruguay|apuestas deportivas

en vivo|apuestas deportivas es|apuestas deportivas es pronosticos|apuestas deportivas españa|apuestas deportivas españolas|apuestas deportivas

esports|apuestas deportivas estadisticas|apuestas deportivas

estrategias|apuestas deportivas estrategias seguras|apuestas deportivas eurocopa|apuestas deportivas europa league|apuestas deportivas f1|apuestas deportivas faciles de ganar|apuestas deportivas

formula 1|apuestas deportivas foro|apuestas deportivas foro futbol|apuestas deportivas

foro tenis|apuestas deportivas francia argentina|apuestas deportivas futbol|apuestas deportivas fútbol|apuestas deportivas futbol

argentino|apuestas deportivas futbol colombia|apuestas deportivas futbol español|apuestas deportivas gana|apuestas deportivas ganadas|apuestas deportivas ganar dinero seguro|apuestas deportivas gane|apuestas deportivas golf|apuestas

deportivas gratis|apuestas deportivas gratis con premios|apuestas deportivas gratis hoy|apuestas deportivas gratis sin deposito|apuestas deportivas handicap|apuestas deportivas handicap asiatico|apuestas deportivas

hoy|apuestas deportivas impuestos|apuestas deportivas interior argentina|apuestas deportivas juegos olimpicos|apuestas deportivas la liga|apuestas deportivas legales|apuestas deportivas legales en colombia|apuestas deportivas libres de impuestos|apuestas deportivas licencia españa|apuestas

deportivas liga española|apuestas deportivas listado|apuestas deportivas

listado clasico|apuestas deportivas madrid|apuestas deportivas mas seguras|apuestas deportivas mejor pagadas|apuestas

deportivas mejores|apuestas deportivas mejores app|apuestas deportivas mejores casas|apuestas deportivas mejores cuotas|apuestas deportivas mejores paginas|apuestas deportivas mexico|apuestas deportivas méxico|apuestas deportivas mlb|apuestas deportivas mlb

hoy|apuestas deportivas multiples|apuestas deportivas mundial|apuestas deportivas murcia|apuestas deportivas nba|apuestas deportivas nba hoy|apuestas deportivas nfl|apuestas deportivas nhl|apuestas deportivas nuevas|apuestas deportivas ofertas|apuestas

deportivas online|apuestas deportivas online argentina|apuestas deportivas online chile|apuestas deportivas online colombia|apuestas deportivas online en colombia|apuestas deportivas online españa|apuestas deportivas online mexico|apuestas deportivas online

paypal|apuestas deportivas online peru|apuestas deportivas online por

internet|apuestas deportivas pago paypal|apuestas deportivas para ganar dinero|apuestas deportivas para hoy|apuestas deportivas

para hoy pronosticos|apuestas deportivas partido suspendido|apuestas deportivas partidos de hoy|apuestas

deportivas paypal|apuestas deportivas peru|apuestas deportivas perú|apuestas deportivas peru vs ecuador|apuestas deportivas predicciones|apuestas deportivas

promociones|apuestas deportivas pronostico|apuestas deportivas pronóstico|apuestas deportivas pronostico

hoy|apuestas deportivas pronosticos|apuestas deportivas pronósticos|apuestas deportivas pronosticos expertos|apuestas deportivas pronosticos gratis|apuestas deportivas pronosticos nba|apuestas deportivas pronosticos

tenis|apuestas deportivas que aceptan paypal|apuestas deportivas

real madrid|apuestas deportivas regalo bienvenida|apuestas deportivas resultado exacto|apuestas deportivas resultados|apuestas deportivas rugby|apuestas

deportivas seguras|apuestas deportivas seguras foro|apuestas deportivas seguras hoy|apuestas deportivas seguras para hoy|apuestas deportivas seguras telegram|apuestas deportivas sevilla|apuestas deportivas simulador eurocopa|apuestas deportivas sin deposito|apuestas deportivas sin deposito inicial|apuestas deportivas sin dinero|apuestas deportivas sin dinero real|apuestas deportivas sin registro|apuestas deportivas stake|apuestas deportivas stake 10|apuestas

deportivas telegram españa|apuestas deportivas tenis|apuestas deportivas tenis de

mesa|apuestas deportivas tenis foro|apuestas deportivas tenis hoy|apuestas deportivas tips|apuestas deportivas tipster|apuestas deportivas ufc|apuestas deportivas uruguay|apuestas deportivas

valencia|apuestas deportivas valencia barcelona|apuestas deportivas venezuela|apuestas deportivas

virtuales|apuestas deportivas y casino|apuestas deportivas y casino online|apuestas deportivas.com|apuestas deportivas.com foro|apuestas deportivas.es|apuestas deportivos pronosticos|apuestas deposito minimo 1 euro|apuestas

descenso a segunda|apuestas descenso a segunda b|apuestas descenso la liga|apuestas descenso

primera division|apuestas descenso segunda|apuestas dia|apuestas diarias seguras|apuestas dinero|apuestas dinero

ficticio|apuestas dinero real|apuestas dinero virtual|apuestas directas|apuestas directo|apuestas directo futbol|apuestas division de honor

juvenil|apuestas dnb|apuestas doble oportunidad|apuestas doble resultado|apuestas dobles|apuestas dobles y triples|apuestas dortmund barcelona|apuestas draft nba|apuestas draft nfl|apuestas ecuador vs

argentina|apuestas ecuador vs venezuela|apuestas egipto uruguay|apuestas el clasico|apuestas elecciones venezuela|apuestas empate|apuestas en baloncesto|apuestas en barcelona|apuestas en beisbol|apuestas en boxeo|apuestas en caballos|apuestas en carreras de caballos|apuestas en casino|apuestas en casino online|apuestas en casinos|apuestas en casinos online|apuestas en chile|apuestas en ciclismo|apuestas en colombia|apuestas en colombia de futbol|apuestas en directo|apuestas en directo futbol|apuestas

en directo pronosticos|apuestas en el futbol|apuestas en el tenis|apuestas en españa|apuestas en esports|apuestas

en eventos deportivos virtuales|apuestas en golf|apuestas en juegos|apuestas en la champions league|apuestas en la eurocopa|apuestas en la liga|apuestas en la nba|apuestas en la nfl|apuestas

en las vegas mlb|apuestas en las vegas nfl|apuestas en linea|apuestas en línea|apuestas

en linea argentina|apuestas en linea boxeo|apuestas en linea

chile|apuestas en linea colombia|apuestas en línea de fútbol|apuestas

en linea deportivas|apuestas en linea españa|apuestas

en linea estados unidos|apuestas en linea futbol|apuestas en linea mexico|apuestas en línea méxico|apuestas en linea mundial|apuestas en linea

peru|apuestas en linea usa|apuestas en los esports|apuestas

en madrid|apuestas en méxico|apuestas en mexico online|apuestas en nba|apuestas en partidos de futbol|apuestas en partidos de futbol en vivo|apuestas en partidos de tenis en directo|apuestas en perú|apuestas

en sevilla|apuestas en sistema|apuestas en stake|apuestas en tenis|apuestas

en tenis de mesa|apuestas en valencia|apuestas en vivo|apuestas en vivo argentina|apuestas en vivo casino|apuestas en vivo futbol|apuestas

en vivo fútbol|apuestas en vivo nba|apuestas en vivo peru|apuestas en vivo tenis|apuestas en vivo ufc|apuestas equipo

mbappe|apuestas equipos de futbol|apuestas españa|apuestas españa alemania|apuestas españa

alemania eurocopa|apuestas españa croacia|apuestas españa

eurocopa|apuestas españa francia|apuestas españa francia eurocopa|apuestas españa gana

el mundial|apuestas españa gana eurocopa|apuestas españa gana mundial|apuestas

españa georgia|apuestas españa holanda|apuestas españa inglaterra|apuestas españa

inglaterra cuotas|apuestas españa inglaterra eurocopa|apuestas españa italia|apuestas españa mundial|apuestas españa paises bajos|apuestas

español|apuestas español oviedo|apuestas espanyol barcelona|apuestas espanyol betis|apuestas espanyol villarreal|apuestas esport|apuestas esports|apuestas esports colombia|apuestas esports españa|apuestas esports fifa|apuestas

esports gratis|apuestas esports lol|apuestas esports

peru|apuestas esports valorant|apuestas estadisticas|apuestas estrategias|apuestas euro|apuestas euro copa|apuestas eurocopa|apuestas eurocopa campeon|apuestas eurocopa españa|apuestas

eurocopa favoritos|apuestas eurocopa femenina|apuestas

eurocopa final|apuestas eurocopa ganador|apuestas eurocopa hoy|apuestas eurocopa sub 21|apuestas euroliga baloncesto|apuestas euroliga pronosticos|apuestas europa

league|apuestas europa league hoy|apuestas europa league pronosticos|apuestas europa league pronósticos|apuestas euros|apuestas f1 abu dhabi|apuestas f1 bahrein|apuestas f1 canada|apuestas f1

china|apuestas f1 cuotas|apuestas f1 hoy|apuestas f1 las vegas|apuestas f1

miami|apuestas f1 monaco|apuestas faciles de ganar|apuestas fáciles de ganar|apuestas faciles para ganar|apuestas favoritas|apuestas favorito champions|apuestas favoritos champions|apuestas favoritos

eurocopa|apuestas favoritos mundial|apuestas fc barcelona|apuestas final champions cuotas|apuestas final champions league|apuestas final champions peru|apuestas final copa|apuestas final copa america|apuestas

final copa de europa|apuestas final copa del rey|apuestas final copa europa|apuestas final copa libertadores|apuestas final copa rey|apuestas final de copa|apuestas final de copa del rey|apuestas final del mundial|apuestas final euro|apuestas final

eurocopa|apuestas final europa league|apuestas final libertadores|apuestas final mundial|apuestas final

nba|apuestas final rugby|apuestas final uefa europa league|apuestas final.mundial|apuestas

finales de conferencia nfl|apuestas finales nba|apuestas fiorentina betis|apuestas formula|apuestas formula

1|apuestas fórmula 1|apuestas fórmula 1 pronósticos|apuestas formula uno|apuestas foro|apuestas foro nba|apuestas francia argentina|apuestas

francia españa|apuestas futbol|apuestas fútbol|apuestas futbol americano|apuestas futbol americano nfl|apuestas futbol argentina|apuestas futbol argentino|apuestas futbol champions league|apuestas futbol chile|apuestas futbol

colombia|apuestas futbol consejos|apuestas futbol en directo|apuestas fútbol

en directo|apuestas futbol en vivo|apuestas fútbol en vivo|apuestas futbol españa|apuestas futbol español|apuestas fútbol español|apuestas futbol eurocopa|apuestas futbol femenino|apuestas futbol foro|apuestas futbol

gratis|apuestas futbol hoy|apuestas fútbol

hoy|apuestas futbol juegos olimpicos|apuestas futbol mexico|apuestas futbol

mundial|apuestas futbol online|apuestas futbol para

hoy|apuestas futbol peru|apuestas futbol pronosticos|apuestas futbol sala|apuestas futbol telegram|apuestas futbol

virtual|apuestas galgos|apuestas galgos en directo|apuestas galgos hoy|apuestas galgos online|apuestas galgos pronosticos|apuestas galgos

trucos|apuestas gana|apuestas gana colombia|apuestas gana resultados|apuestas ganadas|apuestas ganadas hoy|apuestas ganador champions league|apuestas ganador copa america|apuestas

ganador copa del rey|apuestas ganador copa del rey baloncesto|apuestas ganador

copa libertadores|apuestas ganador de la eurocopa|apuestas ganador de la liga|apuestas ganador del mundial|apuestas ganador eurocopa|apuestas ganador

europa league|apuestas ganador f1|apuestas ganador

la liga|apuestas ganador liga española|apuestas

ganador mundial|apuestas ganador mundial baloncesto|apuestas ganador mundial f1|apuestas ganador nba|apuestas ganadores

eurocopa|apuestas ganadores mundial|apuestas ganar champions|apuestas

ganar eurocopa|apuestas ganar liga|apuestas ganar mundial|apuestas ganar

nba|apuestas getafe valencia|apuestas ghana uruguay|apuestas girona|apuestas girona athletic|apuestas girona

betis|apuestas girona campeon de liga|apuestas girona campeon liga|apuestas girona gana la liga|apuestas girona real madrid|apuestas girona real sociedad|apuestas goleador eurocopa|apuestas goleadores eurocopa|apuestas goles asiaticos|apuestas golf|apuestas golf masters|apuestas golf pga|apuestas granada

barcelona|apuestas grand slam de tenis|apuestas gratis|apuestas gratis casino|apuestas gratis

con premios|apuestas gratis hoy|apuestas gratis para hoy|apuestas gratis por registro|apuestas gratis

puntos|apuestas gratis regalos|apuestas gratis sin deposito|apuestas gratis sin depósito|apuestas gratis

sin ingreso|apuestas gratis sports|apuestas gratis y ganar premios|apuestas grupo a eurocopa|apuestas grupos eurocopa|apuestas handicap|apuestas handicap asiatico|apuestas handicap baloncesto|apuestas handicap como funciona|apuestas handicap nba|apuestas

handicap nfl|apuestas hipicas online|apuestas hípicas online|apuestas hipicas

venezuela|apuestas hockey|apuestas hockey hielo|apuestas hockey

patines|apuestas hockey sobre hielo|apuestas holanda argentina|apuestas holanda vs

argentina|apuestas hoy|apuestas hoy champions|apuestas hoy futbol|apuestas hoy nba|apuestas hoy pronosticos|apuestas hoy

seguras|apuestas impuestos|apuestas inglaterra paises bajos|apuestas inter barca|apuestas inter barcelona|apuestas juego|apuestas juegos|apuestas juegos

en linea|apuestas juegos olimpicos|apuestas juegos olímpicos|apuestas juegos olimpicos

baloncesto|apuestas juegos online|apuestas juegos virtuales|apuestas jugador sevilla|apuestas jugadores nba|apuestas kings

league americas|apuestas la liga|apuestas la liga española|apuestas la liga hoy|apuestas la liga

santander|apuestas las vegas mlb|apuestas las vegas nba|apuestas las vegas nfl|apuestas league of legends mundial|apuestas legal|apuestas legales|apuestas legales en colombia|apuestas

legales en españa|apuestas legales en estados unidos|apuestas legales españa|apuestas leganes betis|apuestas libertadores|apuestas licencia|apuestas liga 1 peru|apuestas liga argentina|apuestas liga bbva pronosticos|apuestas liga de campeones|apuestas liga de campeones de baloncesto|apuestas liga de campeones de hockey|apuestas liga españa|apuestas liga española|apuestas liga santander pronosticos|apuestas ligas de futbol|apuestas linea|apuestas linea de gol|apuestas liverpool barcelona|apuestas liverpool real madrid|apuestas lol mundial|apuestas madrid|apuestas madrid arsenal|apuestas

madrid atletico|apuestas madrid atletico champions|apuestas madrid barca|apuestas madrid barça|apuestas madrid barca hoy|apuestas madrid barca supercopa|apuestas madrid barcelona|apuestas madrid barsa|apuestas madrid bayern|apuestas madrid betis|apuestas madrid borussia|apuestas madrid campeon champions|apuestas madrid

celta|apuestas madrid city|apuestas madrid dortmund|apuestas madrid gana la liga|apuestas

madrid gana liga|apuestas madrid hoy|apuestas madrid liverpool|apuestas madrid osasuna|apuestas madrid sevilla|apuestas madrid valencia|apuestas

madrid vs arsenal|apuestas madrid vs barcelona|apuestas mallorca osasuna|apuestas mallorca

real sociedad|apuestas manchester athletic|apuestas manchester city real madrid|apuestas mas faciles de

ganar|apuestas mas seguras|apuestas mas seguras para hoy|apuestas masters de golf|apuestas masters de tenis|apuestas maximo

goleador eurocopa|apuestas maximo goleador mundial|apuestas mejor jugador eurocopa|apuestas mejores casinos online|apuestas mexico|apuestas méxico|apuestas mexico polonia|apuestas méxico

polonia|apuestas mlb|apuestas mlb hoy|apuestas mlb las vegas|apuestas mlb

para hoy|apuestas mlb pronosticos|apuestas mlb usa|apuestas mma ufc|apuestas momios|apuestas multiples|apuestas múltiples|apuestas multiples como funcionan|apuestas multiples el gordo|apuestas multiples futbol|apuestas mundial|apuestas mundial 2026|apuestas mundial baloncesto|apuestas mundial

balonmano|apuestas mundial brasil|apuestas mundial campeon|apuestas mundial ciclismo|apuestas mundial clubes|apuestas

mundial de baloncesto|apuestas mundial de ciclismo|apuestas mundial de clubes|apuestas mundial

de futbol|apuestas mundial de fútbol|apuestas mundial de rugby|apuestas

mundial f1|apuestas mundial favoritos|apuestas

mundial femenino|apuestas mundial formula 1|apuestas mundial futbol|apuestas mundial ganador|apuestas mundial lol|apuestas mundial moto

gp|apuestas mundial motogp|apuestas mundial rugby|apuestas mundial sub 17|apuestas mundiales|apuestas

mundialistas|apuestas mvp eurocopa|apuestas mvp nba|apuestas mvp nfl|apuestas nacionales de colombia|apuestas nba|apuestas nba all star|apuestas nba campeon|apuestas nba consejos|apuestas nba esta noche|apuestas nba finals|apuestas nba gratis|apuestas nba hoy|apuestas nba hoy jugadores|apuestas

nba hoy pronosticos|apuestas nba para hoy|apuestas nba playoffs|apuestas nba pronosticos|apuestas nba pronósticos|apuestas nba pronosticos hoy|apuestas nba tipster|apuestas nfl|apuestas nfl hoy|apuestas

nfl las vegas|apuestas nfl playoffs|apuestas nfl

pronosticos|apuestas nfl pronósticos|apuestas nfl semana

4|apuestas nfl super bowl|apuestas nhl|apuestas nhl pronosticos|apuestas octavos eurocopa|apuestas ofertas|apuestas online|apuestas online argentina|apuestas online argentina legal|apuestas online bono|apuestas online bono bienvenida|apuestas online boxeo|apuestas online

caballos|apuestas online carreras de caballos|apuestas online casino|apuestas online champions league|apuestas online chile|apuestas online ciclismo|apuestas online colombia|apuestas online comparativa|apuestas online con paypal|apuestas online

de caballos|apuestas online deportivas|apuestas online en argentina|apuestas online en peru|apuestas online espana|apuestas online españa|apuestas

online esports|apuestas online foro|apuestas online futbol|apuestas online futbol

españa|apuestas online golf|apuestas online gratis|apuestas online gratis sin deposito|apuestas online juegos|apuestas online

mexico|apuestas online mma|apuestas online movil|apuestas online nba|apuestas online net|apuestas online nuevas|apuestas online opiniones|apuestas online paypal|apuestas online peru|apuestas online seguras|apuestas online sin dinero|apuestas online sin registro|apuestas online tenis|apuestas online ufc|apuestas online uruguay|apuestas online venezuela|apuestas open britanico golf|apuestas osasuna athletic|apuestas osasuna barcelona|apuestas osasuna

real madrid|apuestas osasuna sevilla|apuestas osasuna valencia|apuestas over|apuestas over 2.5|apuestas

over under|apuestas paginas|apuestas pago anticipado|apuestas paises bajos ecuador|apuestas paises bajos inglaterra|apuestas países bajos qatar|apuestas para boxeo|apuestas para champions

league|apuestas para el clasico|apuestas para el dia de hoy|apuestas para el mundial|apuestas para

el partido de hoy|apuestas para eurocopa|apuestas para

europa league|apuestas para futbol|apuestas para ganar|apuestas

para ganar dinero|apuestas para ganar dinero facil|apuestas para ganar en la ruleta|apuestas para ganar la champions|apuestas para ganar la eurocopa|apuestas para ganar la europa league|apuestas para ganar la liga|apuestas para ganar siempre|apuestas para hacer|apuestas para hoy|apuestas

para hoy de futbol|apuestas para hoy europa league|apuestas

para hoy futbol|apuestas para juegos|apuestas

para la champions league|apuestas para la copa

del rey|apuestas para la eurocopa|apuestas para la europa league|apuestas para

la final de la eurocopa|apuestas para la nba hoy|apuestas para

los partidos de hoy|apuestas para partidos de hoy|apuestas para ufc|apuestas partido|apuestas

partido aplazado|apuestas partido champions|apuestas partido colombia|apuestas partido

españa marruecos|apuestas partido mundial|apuestas partido suspendido|apuestas partidos|apuestas partidos champions league|apuestas partidos csgo|apuestas

partidos de futbol|apuestas partidos de futbol hoy|apuestas partidos de hoy|apuestas partidos eurocopa|apuestas partidos futbol|apuestas partidos hoy|apuestas partidos mundial|apuestas paypal|apuestas

peleas de boxeo|apuestas peru|apuestas perú|apuestas

peru brasil|apuestas peru chile|apuestas peru paraguay|apuestas peru uruguay|apuestas peru vs

chile|apuestas peru vs colombia|apuestas pichichi eurocopa|apuestas plataforma|apuestas playoff|apuestas playoff ascenso|apuestas playoff ascenso a primera|apuestas playoff nba|apuestas playoff

segunda|apuestas playoff segunda b|apuestas playoffs nba|apuestas playoffs nfl|apuestas

polonia argentina|apuestas por argentina|apuestas por internet mexico|apuestas

por internet para ganar dinero|apuestas por paypal|apuestas por

ronda boxeo|apuestas por sistema|apuestas portugal uruguay|apuestas

pre partido|apuestas predicciones|apuestas predicciones futbol|apuestas primera division|apuestas primera division españa|apuestas promociones|apuestas pronostico|apuestas pronosticos|apuestas pronosticos deportivos|apuestas pronosticos deportivos tenis|apuestas pronosticos

futbol|apuestas pronosticos gratis|apuestas pronosticos

nba|apuestas pronosticos tenis|apuestas prorroga|apuestas psg barca|apuestas psg

barcelona|apuestas puntos por tarjetas|apuestas puntos tarjetas|apuestas que aceptan paypal|apuestas que es handicap|apuestas que puedes hacer con tu

novia|apuestas que siempre ganaras|apuestas que significa|apuestas

quien bajara a segunda|apuestas quién bajara a segunda|apuestas quien gana el mundial|apuestas quien gana

eurocopa|apuestas quien gana la champions|apuestas quien gana la eurocopa|apuestas quien gana

la liga|apuestas quien ganara el mundial|apuestas quién ganará el mundial|apuestas quien ganara la

champions|apuestas quien ganara la eurocopa|apuestas

quien ganara la liga|apuestas rayo barcelona|apuestas real

madrid|apuestas real madrid arsenal|apuestas real madrid athletic|apuestas real madrid

atletico|apuestas real madrid atletico champions|apuestas real madrid atletico de madrid|apuestas real madrid atlético de madrid|apuestas real madrid atletico

madrid|apuestas real madrid barcelona|apuestas real madrid bayern|apuestas real madrid betis|apuestas

real madrid borussia|apuestas real madrid campeon champions|apuestas real madrid celta|apuestas real madrid champions|apuestas real madrid city|apuestas

real madrid girona|apuestas real madrid hoy|apuestas real madrid

liverpool|apuestas real madrid manchester city|apuestas

real madrid osasuna|apuestas real madrid real sociedad|apuestas real madrid valencia|apuestas real

madrid villarreal|apuestas real madrid vs arsenal|apuestas real madrid vs atletico|apuestas real madrid vs atlético|apuestas

real madrid vs atletico madrid|apuestas real madrid vs barcelona|apuestas real madrid vs betis|apuestas real madrid vs sevilla|apuestas real madrid vs

valencia|apuestas real sociedad|apuestas real sociedad athletic|apuestas real sociedad barcelona|apuestas real sociedad betis|apuestas

real sociedad psg|apuestas real sociedad real madrid|apuestas real

sociedad valencia|apuestas recomendadas hoy|apuestas regalo de bienvenida|apuestas registro|apuestas resultado exacto|apuestas resultados|apuestas

resultados eurocopa|apuestas retirada tenis|apuestas roma barcelona|apuestas

roma sevilla|apuestas rugby|apuestas rugby mundial|apuestas rugby world cup|apuestas ruleta seguras|apuestas segunda|apuestas

segunda b|apuestas segunda division|apuestas segunda división|apuestas segunda division b|apuestas segunda division españa|apuestas seguras|apuestas seguras baloncesto|apuestas seguras calculadora|apuestas seguras en la ruleta|apuestas seguras eurocopa|apuestas seguras

foro|apuestas seguras futbol|apuestas seguras futbol hoy|apuestas seguras gratis|apuestas seguras hoy|apuestas seguras hoy futbol|apuestas seguras nba|apuestas seguras nba

hoy|apuestas seguras para este fin de semana|apuestas seguras para ganar dinero|apuestas seguras para hoy|apuestas seguras para hoy fútbol|apuestas seguras

para hoy pronósticos|apuestas seguras para

mañana|apuestas seguras ruleta|apuestas seguras telegram|apuestas seguras tenis|apuestas semifinales

eurocopa|apuestas senegal paises bajos|apuestas sevilla|apuestas sevilla athletic|apuestas sevilla

atletico de madrid|apuestas sevilla barcelona|apuestas sevilla

betis|apuestas sevilla campeon liga|apuestas sevilla celta|apuestas sevilla gana la liga|apuestas sevilla girona|apuestas sevilla inter|apuestas sevilla jugador|apuestas sevilla juventus|apuestas sevilla

leganes|apuestas sevilla madrid|apuestas sevilla

manchester united|apuestas sevilla osasuna|apuestas sevilla real

madrid|apuestas sevilla real sociedad|apuestas sevilla roma|apuestas sevilla valencia|apuestas significa|apuestas simples ejemplos|apuestas simples o

combinadas|apuestas sin deposito|apuestas sin deposito inicial|apuestas sin deposito minimo|apuestas sin dinero|apuestas sin dinero real|apuestas sin empate|apuestas sin empate que significa|apuestas sin ingreso minimo|apuestas sin registro|apuestas sistema|apuestas

sistema calculadora|apuestas sistema como funciona|apuestas

sistema trixie|apuestas sociedad|apuestas sorteo copa del rey|apuestas stake|apuestas stake 10|apuestas stake 10

hoy|apuestas super bowl favorito|apuestas super rugby|apuestas supercopa españa|apuestas superliga argentina|apuestas tarjeta roja|apuestas

tarjetas|apuestas tarjetas amarillas|apuestas tenis|apuestas tenis atp|apuestas tenis consejos|apuestas tenis copa davis|apuestas tenis de mesa|apuestas tenis de mesa pronosticos|apuestas tenis en vivo|apuestas

tenis femenino|apuestas tenis hoy|apuestas tenis

itf|apuestas tenis pronosticos|apuestas tenis pronósticos|apuestas tenis

retirada|apuestas tenis roland garros|apuestas tenis seguras|apuestas tenis wimbledon|apuestas tenis

wta|apuestas tercera division|apuestas tercera division españa|apuestas tipos|apuestas tips|apuestas tipster|apuestas

tipster para hoy|apuestas topuria holloway cuotas|apuestas torneos de golf|apuestas torneos

de tenis|apuestas trucos|apuestas uefa champions league|apuestas uefa europa league|apuestas ufc|apuestas ufc chile|apuestas ufc como funciona|apuestas ufc hoy|apuestas ufc ilia topuria|apuestas ufc online|apuestas ufc pronósticos|apuestas

ufc telegram|apuestas ufc topuria|apuestas under over|apuestas unionistas villarreal|apuestas uruguay|apuestas uruguay colombia|apuestas

uruguay corea|apuestas uruguay vs colombia|apuestas us open golf|apuestas us open tenis|apuestas valencia|apuestas valencia barcelona|apuestas valencia betis|apuestas valencia madrid|apuestas valencia

real madrid|apuestas valladolid barcelona|apuestas valladolid valencia|apuestas valor

app|apuestas valor en directo|apuestas valor galgos|apuestas venezuela|apuestas venezuela

argentina|apuestas venezuela bolivia|apuestas venezuela ecuador|apuestas villarreal|apuestas villarreal athletic|apuestas villarreal barcelona|apuestas villarreal bayern|apuestas villarreal betis|apuestas villarreal liverpool|apuestas villarreal manchester|apuestas villarreal manchester united|apuestas villarreal vs real madrid|apuestas virtuales|apuestas virtuales colombia|apuestas virtuales futbol|apuestas virtuales sin dinero|apuestas vivo|apuestas vuelta a españa|apuestas vuelta españa|apuestas william hill partidos de hoy|apuestas y casino|apuestas

y casinos|apuestas y juegos de azar|apuestas y pronosticos|apuestas

y pronosticos de futbol|apuestas y pronosticos deportivos|apuestas y resultados|apuestas-deportivas|apuestas-deportivas.es pronosticos|arbitro nba apuestas|argentina apuestas|argentina colombia apuestas|argentina croacia apuestas|argentina francia apuestas|argentina mexico apuestas|argentina peru apuestas|argentina

uruguay apuestas|argentina vs bolivia apuestas|argentina vs chile apuestas|argentina vs

colombia apuestas|argentina vs francia apuestas|argentina vs.

colombia apuestas|asi se gana en las apuestas deportivas|asiatico apuestas|asiatico en apuestas|asiaticos apuestas|athletic barcelona apuestas|athletic manchester united apuestas|athletic osasuna apuestas|athletic real madrid apuestas|atletico barcelona

apuestas|atletico de madrid apuestas|atlético de madrid

apuestas|atletico de madrid real madrid apuestas|atletico de

madrid vs barcelona apuestas|atletico madrid real madrid apuestas|atletico madrid vs real madrid apuestas|atletico real madrid

apuestas|atletico vs real madrid apuestas|avisador de cuotas apuestas|bajada de cuotas apuestas|baloncesto apuestas|barbastro barcelona apuestas|barca apuestas|barca bayern apuestas|barca inter apuestas|barca madrid

apuestas|barça madrid apuestas|barca vs atletico apuestas|barca vs madrid apuestas|barca vs real madrid apuestas|barcelona – real madrid apuestas|barcelona

apuestas|barcelona atletico apuestas|barcelona atletico

de madrid apuestas|barcelona atletico madrid apuestas|barcelona betis apuestas|barcelona casa de apuestas|barcelona inter apuestas|barcelona psg apuestas|barcelona real madrid apuestas|barcelona real

sociedad apuestas|barcelona sevilla apuestas|barcelona valencia apuestas|barcelona vs athletic bilbao

apuestas|barcelona vs atlético madrid apuestas|barcelona vs betis apuestas|barcelona vs celta de vigo

apuestas|barcelona vs espanyol apuestas|barcelona vs

girona apuestas|barcelona vs madrid apuestas|barcelona vs real madrid apuestas|barcelona vs real sociedad apuestas|barcelona vs sevilla apuestas|barcelona vs villarreal

apuestas|base de datos cuotas apuestas deportivas|bayern real madrid apuestas|beisbol apuestas|best america apuestas|bet apuestas

chile|bet apuestas en vivo|betis – chelsea apuestas|betis apuestas|betis barcelona apuestas|betis

chelsea apuestas|betis madrid apuestas|betis sevilla apuestas|betsson tu sitio de apuestas online|blog apuestas baloncesto|blog apuestas ciclismo|blog apuestas nba|blog apuestas tenis|blog de apuestas

de tenis|bono apuestas|bono apuestas deportivas|bono apuestas deportivas sin deposito|bono apuestas gratis|bono apuestas gratis sin deposito|bono apuestas sin deposito|bono bienvenida apuestas|bono bienvenida apuestas deportivas|bono bienvenida apuestas españa|bono bienvenida

apuestas sin deposito|bono bienvenida apuestas sin depósito|bono bienvenida

casa apuestas|bono bienvenida casa de apuestas|bono bienvenida marca apuestas|bono casa apuestas|bono casa de apuestas|bono casa

de apuestas sin ingreso|bono casas de apuestas|bono de apuestas|bono de

apuestas gratis sin deposito|bono de bienvenida apuestas|bono

de bienvenida apuestas deportivas|bono de bienvenida casa de apuestas|bono de bienvenida casas de

apuestas|bono de casas de apuestas|bono de registro apuestas|bono de registro apuestas deportivas|bono de registro casa de

apuestas|bono gratis apuestas|bono marca apuestas|bono por

registro apuestas|bono por registro apuestas deportivas|bono por registro casa de apuestas|bono registro apuestas|bono sin deposito apuestas|bono sin depósito apuestas|bono sin deposito apuestas deportivas|bono sin depósito apuestas

deportivas|bono sin deposito casa de apuestas|bono sin deposito marca apuestas|bono sin ingreso apuestas|bono sin ingreso apuestas

deportivas|bonos apuestas|bonos apuestas colombia|bonos apuestas deportivas|bonos apuestas deportivas sin deposito|bonos

apuestas gratis|bonos apuestas sin deposito|bonos apuestas sin depósito|bonos

bienvenida apuestas|bonos bienvenida casas apuestas|bonos bienvenida casas de apuestas|bonos casa de apuestas|bonos casas

apuestas|bonos casas de apuestas|bonos casas de apuestas colombia|bonos casas de

apuestas deportivas|bonos casas de apuestas españa|bonos casas de apuestas nuevas|bonos

casas de apuestas sin deposito|bonos casas de apuestas sin depósito|bonos

de apuestas|bonos de apuestas deportivas|bonos de apuestas gratis|bonos de apuestas sin deposito|bonos de bienvenida apuestas|bonos de bienvenida apuestas deportivas|bonos de bienvenida casa de apuestas|bonos de bienvenida casas de apuestas|bonos de

bienvenida de casas de apuestas|bonos de bienvenida en casas de apuestas|bonos de casas de apuestas|bonos de casas de apuestas

sin deposito|bonos en casa de apuestas|bonos en casas

de apuestas sin deposito|bonos gratis apuestas|bonos gratis apuestas deportivas|bonos gratis casas de

apuestas|bonos gratis sin deposito apuestas|bonos paginas de apuestas|bonos

registro casas de apuestas|bonos sin deposito apuestas|bonos sin depósito apuestas|bonos sin deposito apuestas deportivas|bonos sin deposito casas de apuestas|bot

de apuestas deportivas gratis|boxeo apuestas|brasil colombia apuestas|brasil peru apuestas|brasil vs colombia apuestas|buenas apuestas

para hoy|buscador cuotas apuestas|buscador de apuestas seguras|buscador de cuotas apuestas|buscador de cuotas de apuestas|buscar apuestas

seguras|caballos apuestas|calculador de apuestas|calculador de cuotas apuestas|calculadora apuestas|calculadora

apuestas combinadas|calculadora apuestas de sistema|calculadora apuestas

deportivas|calculadora apuestas deportivas seguras|calculadora apuestas multiples|calculadora

apuestas segura|calculadora apuestas seguras|calculadora apuestas

sistema|calculadora apuestas yankee|calculadora arbitraje apuestas|calculadora

cubrir apuestas|calculadora cuotas apuestas|calculadora de apuestas|calculadora de apuestas combinadas|calculadora

de apuestas de futbol|calculadora de apuestas

de sistema|calculadora de apuestas deportivas|calculadora de apuestas multiples|calculadora de apuestas seguras|calculadora

de apuestas sistema|calculadora de apuestas surebets|calculadora de arbitraje apuestas|calculadora de cuotas apuestas|calculadora de cuotas de apuestas|calculadora para

apuestas deportivas|calculadora poisson apuestas|calculadora

poisson apuestas deportivas|calculadora poisson para apuestas|calculadora scalping apuestas

deportivas|calculadora sistema apuestas|calculadora stake apuestas|calculadora trading apuestas|calcular apuestas|calcular apuestas deportivas|calcular apuestas

futbol|calcular apuestas sistema|calcular cuotas apuestas|calcular cuotas apuestas combinadas|calcular

cuotas apuestas deportivas|calcular cuotas de apuestas|calcular ganancias apuestas deportivas|calcular momios

apuestas|calcular probabilidad cuota apuestas|calcular stake apuestas|calcular

unidades apuestas|calcular yield apuestas|calculo de apuestas|calculo

de apuestas deportivas|cambio de cuotas apuestas|campeon champions apuestas|campeon eurocopa apuestas|campeon liga apuestas|campeon nba apuestas|canales de apuestas gratis|carrera de

caballos apuestas|carrera de caballos apuestas juego|carrera

de caballos con apuestas|carrera de galgos apuestas|carreras de caballos apuestas|carreras de caballos apuestas online|carreras de caballos con apuestas|carreras de caballos

juegos de apuestas|carreras de galgos apuestas|carreras de

galgos apuestas online|carreras de galgos apuestas trucos|carreras galgos apuestas|casa apuestas

argentina|casa apuestas atletico de madrid|casa apuestas barcelona|casa apuestas betis|casa apuestas bono

bienvenida|casa apuestas bono gratis|casa apuestas bono sin deposito|casa apuestas cerca de mi|casa apuestas chile|casa apuestas colombia|casa apuestas con mejores cuotas|casa apuestas deportivas|casa

apuestas españa|casa apuestas española|casa apuestas eurocopa|casa

apuestas futbol|casa apuestas mejores cuotas|casa apuestas mundial|casa apuestas nueva|casa apuestas nuevas|casa apuestas online|casa apuestas peru|casa apuestas valencia|casa de

apuestas|casa de apuestas 10 euros gratis|casa de apuestas argentina|casa de apuestas atletico de madrid|casa de apuestas baloncesto|casa de apuestas barcelona|casa

de apuestas beisbol|casa de apuestas betis|casa de apuestas bono|casa de apuestas bono bienvenida|casa de apuestas bono de bienvenida|casa de apuestas bono gratis|casa de

apuestas bono por registro|casa de apuestas bono sin deposito|casa de apuestas boxeo|casa de apuestas

caballos|casa de apuestas carreras de caballos|casa de apuestas

cerca de mi|casa de apuestas cerca de mí|casa de apuestas champions league|casa de apuestas chile|casa de apuestas ciclismo|casa de

apuestas colombia|casa de apuestas con bono de bienvenida|casa de apuestas con bono sin deposito|casa de apuestas

con cuotas mas altas|casa de apuestas con esports|casa de apuestas con las mejores cuotas|casa de apuestas con licencia en españa|casa de apuestas con mejores cuotas|casa

de apuestas con pago anticipado|casa de apuestas con paypal|casa de apuestas copa america|casa de apuestas de caballos|casa de apuestas de colombia|casa de

apuestas de españa|casa de apuestas de futbol|casa de apuestas

de fútbol|casa de apuestas de futbol peru|casa de apuestas de peru|casa

de apuestas del madrid|casa de apuestas del real madrid|casa de apuestas deportivas|casa de apuestas deportivas

cerca de mi|casa de apuestas deportivas en argentina|casa de

apuestas deportivas en chile|casa de apuestas deportivas

en colombia|casa de apuestas deportivas en españa|casa de apuestas deportivas en madrid|casa de apuestas

deportivas españa|casa de apuestas deportivas españolas|casa de apuestas deportivas madrid|casa de apuestas deportivas

mexico|casa de apuestas deportivas online|casa de apuestas deportivas peru|casa de

apuestas deposito 5 euros|casa de apuestas deposito minimo|casa de apuestas deposito minimo 1 euro|casa de apuestas depósito mínimo 1 euro|casa de apuestas

en españa|casa de apuestas en linea|casa de apuestas en madrid|casa de apuestas en perú|casa de apuestas en vivo|casa de apuestas españa|casa de apuestas españa

inglaterra|casa de apuestas española|casa de apuestas españolas|casa de apuestas esports|casa de apuestas eurocopa|casa de apuestas europa league|casa de

apuestas f1|casa de apuestas formula 1|casa de apuestas futbol|casa de apuestas

ingreso minimo|casa de apuestas ingreso minimo

1 euro|casa de apuestas ingreso mínimo 1 euro|casa de apuestas legales|casa de apuestas

legales en colombia|casa de apuestas legales en españa|casa de apuestas libertadores|casa de apuestas liga española|casa de apuestas madrid|casa de apuestas mas segura|casa de apuestas

mejores|casa de apuestas méxico|casa de apuestas minimo

5 euros|casa de apuestas mlb|casa de apuestas mundial|casa de

apuestas nba|casa de apuestas nfl|casa de apuestas nueva|casa de

apuestas nuevas|casa de apuestas oficial del

real madrid|casa de apuestas oficial real madrid|casa de apuestas online|casa de apuestas online argentina|casa de apuestas online chile|casa de apuestas online españa|casa de apuestas online mexico|casa

de apuestas online paraguay|casa de apuestas online peru|casa de

apuestas online usa|casa de apuestas online venezuela|casa de apuestas pago anticipado|casa de apuestas para boxeo|casa de apuestas para ufc|casa de apuestas peru|casa de apuestas perú|casa de apuestas peru online|casa de apuestas por paypal|casa de apuestas promociones|casa de apuestas que regalan dinero|casa de apuestas real madrid|casa de apuestas regalo de

bienvenida|casa de apuestas sevilla|casa de apuestas sin dinero|casa

de apuestas sin ingreso minimo|casa de apuestas sin licencia

en españa|casa de apuestas sin minimo de ingreso|casa de apuestas

stake|casa de apuestas tenis|casa de apuestas ufc|casa

de apuestas valencia|casa de apuestas venezuela|casa de apuestas virtuales|casa de apuestas vive la suerte|casa oficial de apuestas del real madrid|casas apuestas asiaticas|casas apuestas

bono sin deposito|casas apuestas bonos sin deposito|casas apuestas

caballos|casas apuestas chile|casas apuestas ciclismo|casas apuestas con licencia|casas apuestas con licencia en españa|casas apuestas deportivas|casas apuestas deportivas colombia|casas apuestas deportivas españa|casas apuestas deportivas españolas|casas apuestas deportivas nuevas|casas apuestas españa|casas apuestas

españolas|casas apuestas esports|casas apuestas eurocopa|casas apuestas golf|casas

apuestas ingreso minimo 5 euros|casas apuestas legales|casas apuestas legales españa|casas apuestas licencia|casas apuestas licencia españa|casas apuestas mexico|casas apuestas mundial|casas apuestas nba|casas apuestas nuevas|casas apuestas nuevas españa|casas apuestas ofertas|casas apuestas online|casas apuestas paypal|casas apuestas peru|casas apuestas sin licencia|casas apuestas tenis|casas asiaticas apuestas|casas de apuestas|casas de

apuestas 5 euros|casas de apuestas app|casas de apuestas argentinas|casas de apuestas asiaticas|casas de apuestas baloncesto|casas de apuestas

barcelona|casas de apuestas bono bienvenida|casas de apuestas bono

de bienvenida|casas de apuestas bono por registro|casas de

apuestas bono sin deposito|casas de apuestas bono sin ingreso|casas de apuestas bonos|casas de apuestas bonos de bienvenida|casas de apuestas

bonos gratis|casas de apuestas bonos sin deposito|casas de apuestas boxeo|casas de apuestas caballos|casas de apuestas carreras de caballos|casas de

apuestas casino|casas de apuestas casino online|casas de apuestas cerca de mi|casas de apuestas champions league|casas de apuestas chile|casas de

apuestas ciclismo|casas de apuestas colombia|casas de apuestas com|casas de apuestas

con app|casas de apuestas con apuestas gratis|casas de apuestas con bono|casas

de apuestas con bono de bienvenida|casas de apuestas con bono de registro|casas

de apuestas con bono por registro|casas de apuestas con bono

sin deposito|casas de apuestas con bonos|casas de apuestas con bonos gratis|casas de apuestas con bonos sin deposito|casas de apuestas con deposito minimo|casas de apuestas con esports|casas de apuestas con handicap asiatico|casas de

apuestas con licencia|casas de apuestas con licencia en españa|casas de apuestas con licencia españa|casas

de apuestas con licencia española|casas de apuestas con mejores cuotas|casas de

apuestas con pago anticipado|casas de apuestas con paypal|casas de apuestas con paypal

en perú|casas de apuestas con promociones|casas

de apuestas con ruleta en vivo|casas de apuestas copa del rey|casas de apuestas de caballos|casas

de apuestas de españa|casas de apuestas de futbol|casas de apuestas de fútbol|casas de apuestas de

peru|casas de apuestas deportivas|casas de apuestas deportivas asiaticas|casas de apuestas

deportivas colombia|casas de apuestas deportivas comparativa|casas de apuestas deportivas con paypal|casas de apuestas deportivas en chile|casas de

apuestas deportivas en españa|casas de apuestas deportivas en linea|casas de apuestas deportivas en madrid|casas de apuestas deportivas en mexico|casas de apuestas deportivas en peru|casas de apuestas deportivas en sevilla|casas de

apuestas deportivas en valencia|casas de apuestas deportivas españa|casas de apuestas deportivas españolas|casas de apuestas

deportivas legales|casas de apuestas deportivas madrid|casas de apuestas deportivas mexico|casas de

apuestas deportivas nuevas|casas de apuestas deportivas

online|casas de apuestas deportivas peru|casas de apuestas deportivas perú|casas

de apuestas deposito minimo 1 euro|casas de apuestas depósito mínimo 1

euro|casas de apuestas dinero gratis|casas de apuestas en argentina|casas de apuestas en barcelona|casas

de apuestas en chile|casas de apuestas en colombia|casas de apuestas

en españa|casas de apuestas en españa online|casas

de apuestas en linea|casas de apuestas en madrid|casas

de apuestas en méxico|casas de apuestas en peru|casas de apuestas en perú|casas de apuestas en sevilla|casas de apuestas

en uruguay|casas de apuestas en valencia|casas de apuestas en venezuela|casas de

apuestas equipos de futbol|casas de apuestas españa|casas de

apuestas españa alemania|casas de apuestas españa inglaterra|casas de

apuestas españa licencia|casas de apuestas españa

nuevas|casas de apuestas españa online|casas de apuestas española|casas de apuestas españolas|casas de apuestas españolas con licencia|casas de apuestas españolas online|casas de apuestas esports|casas de apuestas eurocopa|casas

de apuestas eurocopa 2024|casas de apuestas europa league|casas de apuestas f1|casas de apuestas fisicas en barcelona|casas de apuestas

fisicas en españa|casas de apuestas formula 1|casas de apuestas

fuera de españa|casas de apuestas futbol|casas de apuestas fútbol|casas de apuestas futbol españa|casas de apuestas ganador eurocopa|casas de apuestas

gratis|casas de apuestas ingreso minimo|casas de apuestas

ingreso minimo 1 euro|casas de apuestas ingreso minimo 5 euros|casas